It's time to talk about overdraft - Banking info

What is Overdraft?

Loan arrangement under which a bank extends credit up to a maximum amount (called overdraft limit) against which a current (checking) account customer can write checks or make withdrawals. The most common form of business borrowing, an overdraft is a type of revolving loan where deposits (credits) are available for re-borrowing, and interest is charged only on the daily overdraft (debit) balance. It is, however, also a demand loan: the facility can be cancelled (and entire outstanding amount 'called') at any time by the lender at its discretion, without any warning notice or explanation. If the overdraft is secured by an asset or property, the lender has the right to foreclose on the collateral in case the account holder does not pay.Overdrafts can be useful for short-term borrowing, for example, to tide you over until payday. Their advantage is that they’re flexible and that you can dip into them at any time while your agreement lasts. You can also repay your overdraft whenever you like, without any early repayment charges.

Many types of checking account transactions can trigger an overdraft on your account, Feddis says, including:

- Paper checks.

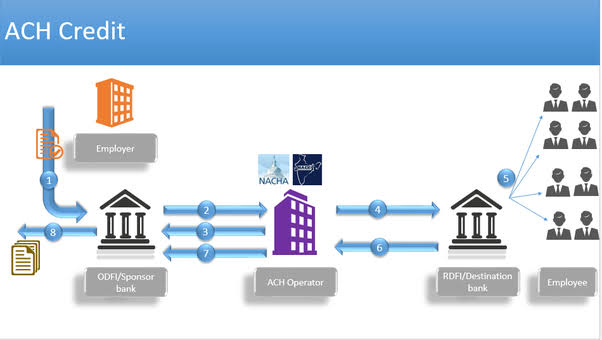

- Automated Clearing House bill-pay transactions.

- ATM withdrawals.

- Debit card transactions.

Types of overdraft

- Authorised overdrafts: are arranged in advance. You agree a borrowing limit with your bank, and you can spend money up to that limit through all the normal payment methods.

- Unauthorised overdrafts: also known as unplanned overdrafts, happen when you spend more than you have in your bank account without agreeing it in advance, or if your bank has agreed an overdraft for you but you go over the limit they’ve set. You will pay extra charges and these can mount up very quickly.

Best ways to deal with overdrafts

1. Opt out: Under consumer protection rules, banks have to get your OK before enrolling you for ATM and debit card overdraft protection.Despite the potentially high costs of opting in, many account holders still do so, says Weinstock, perhaps because they don’t understand what they’re agreeing to.

In two recent surveys conducted by Pew, more than half of the people who had incurred an overdraft in the preceding year were not aware that they had opted into overdraft.

Fortunately, you are free to contact your bank at any time to opt out of overdraft, Weinstock says (so if you haven’t, you may want to go do that right now). Reminder, though: Opting out does not protect you from incurring fees if you bounce a check.

2. Keep closer tabs on your checking account: Many banks offer a variety of tools that can help account holders stay up to date on their balances and avoid overdrafts, says the ABA’s Feddis.

“There are banks that will offer alerts — you can set up an alert so when the balance falls below a certain amount” you’ll be notified, Feddis says.

Online and mobile banking also can help customers check their balance easily, but Feddis cautions that checks written against your account may not show up on your online statement until it’s too late.

“To avoid overdrafts, it’s important to check and keep track of transactions,” Feddis says.

3. Set up a linked account as a backup: Many banks offer the ability to link your checking account to a savings account or line of credit to help avoid overdrafts. Once that link is in place, rather than triggering an overdraft, the bank will automatically transfer funds from a linked account into your checking account to cover any shortfall.

4. Read your bank’s letters: It’s easy to get in the habit of not opening letters from the bank and assuming they are just routine correspondence.

It’s important to check all letters as the bank might be writing to tell you about a change to your overdraft limit or increase to your overdraft fees.

5. Ask your bank to waive the fee:If you slip up and end up with a fee, ask the bank if they’ll waive it.

You’ll usually pay a fee for such “emergency transfers,” Weinstock says, but it’s usually less than an overdraft fee.

Comments

Post a Comment